Nordea Osake: The Leading Finnish Equity Fund For Long-Term Growth

Are you looking for a Finnish equity fund with a solid track record and a focus on long-term growth? Nordea Osake Fund has a long history of delivering superior returns, making it a preferred choice for investors seeking steady growth in the Finnish stock market.

Editor's Notes: Nordea Osake: The Leading Finnish Equity Fund For Long-Term Growth has published today date. This topic is important to read because it will provide you with valuable insights into the Nordea Osake Fund, which has a proven track record of generating strong returns for its investors.

Our research team has done extensive research and compiled extensive information to create a guide on Nordea Osake: The Leading Finnish Equity Fund For Long-Term Growth. This guide will help investors make informed decisions about their investments and achieve their long-term growth goals.

Key differences or Key takeways

| Feature | Nordea Osake |

|---|---|

| Investment Goal | Long-Term Growth |

| Asset Class | Finnish Equities |

| Management Fee | 1.2% |

| Performance | Outperformed the benchmark index over the past 10 years |

Transition to main article topics

Private Equity Fund Structure | A Simple Model - Source www.asimplemodel.com

FAQ

Welcome to the FAQ section for Nordea Osake, the leading Finnish equity fund for long-term growth. This section provides answers to some of the most frequently asked questions about our fund.

Top Pricing Strategies on Amazon for Long-Term Growth - Source prisync.com

Question 1: What is the investment objective of Nordea Osake?

Nordea Osake seeks to provide long-term capital appreciation by investing primarily in Finnish equities. The fund aims to outperform the benchmark index, the Helsinki Stock Exchange Cap Index.

Question 2: What is the investment strategy of Nordea Osake?

The fund employs a bottom-up stock-picking approach, focusing on identifying undervalued companies with strong growth potential. The fund manager conducts in-depth research and analysis to select companies with sustainable competitive advantages.

Question 3: What is the risk profile of Nordea Osake?

As an equity fund, Nordea Osake carries a higher level of risk than fixed income investments. The fund's value can fluctuate significantly over time, and investors should be prepared to tolerate potential losses. However, the fund's long-term track record and focus on quality companies mitigate some of these risks.

Question 4: What is the minimum investment amount for Nordea Osake?

The minimum investment amount varies depending on the distribution channel. Please contact your local Nordea representative for specific details.

Question 5: Are there any fees associated with investing in Nordea Osake?

Yes, there are management fees and other expenses associated with investing in Nordea Osake. These fees are detailed in the fund's prospectus, which is available on our website.

Question 6: How can I invest in Nordea Osake?

You can invest in Nordea Osake through your local Nordea representative, online banking, or a financial advisor. Please contact us for more information on how to open an account and invest in the fund.

In summary, Nordea Osake is a well-established equity fund with a proven track record of delivering long-term growth for investors. Its focus on Finnish equities and rigorous stock-picking process make it an attractive option for those seeking exposure to the Finnish stock market.

Please note that this FAQ section is for informational purposes only and should not be considered investment advice. Before making any investment decisions, investors should carefully consider their investment objectives, financial situation, and risk tolerance.

SBI Focused Equity Fund Regular Growth - A Smart Investment Choice - Source thetechytalks.com

Tips

As Nordea Osake: The Leading Finnish Equity Fund For Long-Term Growth we have a number of tips that can help you make the most out of long-term investments, regardless of your current financial situation.

Tip 1: Start early

The earlier you start investing, the more time your money has to grow. Starting early takes advantage of compound interest, which is the interest you earn on your initial investment and on the interest you've earned in the past.

Tip 2: Invest regularly

Investing regularly, through a method known as "dollar-cost averaging," helps to reduce the risk of investing at the wrong time and can help you make the most of market fluctuations.

Tip 3: Diversify your Investments

Think about which asset classes and investments you should include in your portfolio. By diversifying your investments across different asset classes (such as stocks, bonds, and cash) you are reducing your overall risk

Tip 4: Rebalance your portfolio

Over time, the performance of different asset classes will vary, so it's important to rebalance your portfolio periodically to ensure that it still meets your risk tolerance and financial goals.

Tip 5: Stay invested

Long-term investing comes with ups and downs, so it's important to stay invested through market fluctuations. It can be tempting to sell your investments when the market is down, but if you do, you'll lock in your losses. Instead, ride out the storm and you'll be more likely to reap the rewards of long-term growth.

By following these tips, you can increase your chances of achieving your long-term financial goals.

Nordea Osake: The Leading Finnish Equity Fund For Long-Term Growth

Nordea Osake, Finland's premier equity fund, stands out for its unparalleled ability to generate long-term growth. Six key aspects underpin its success, shaping its strategy and delivering consistent returns for investors.

- Proven Track Record: Nordea Osake's consistent performance over decades is a testament to its effective investment strategies.

- Experienced Management: The fund is led by seasoned investment professionals with deep market knowledge and a proven ability to navigate market cycles.

- Focus on Quality: Nordea Osake invests in high-quality companies with strong fundamentals and sustainable growth potential.

- Long-Term Horizon: The fund adopts a long-term investment horizon, allowing companies to realize their full growth potential.

- Diversification: To mitigate risk, the fund diversifies its portfolio across multiple sectors and companies.

- Competitive Fees: Nordea Osake's competitive fee structure ensures that investors maximize their returns.

These six key aspects have propelled Nordea Osake to the forefront of Finnish equity funds. Its proven track record, experienced management, focus on quality, long-term horizon, diversification, and competitive fees make it an ideal choice for investors seeking long-term growth and financial security.

Fairtree Silver Oak Equity Long Short SNN Retail Hedge Fund - Direct - Source fairtree.com

Nordea Osake: The Leading Finnish Equity Fund For Long-Term Growth

Nordea Osake is a Finnish equity fund that invests in Finnish companies. The fund has a long-term investment horizon and aims to provide investors with capital appreciation over time. Nordea Osake is managed by Nordea Investment Management, a leading asset manager in the Nordic region.

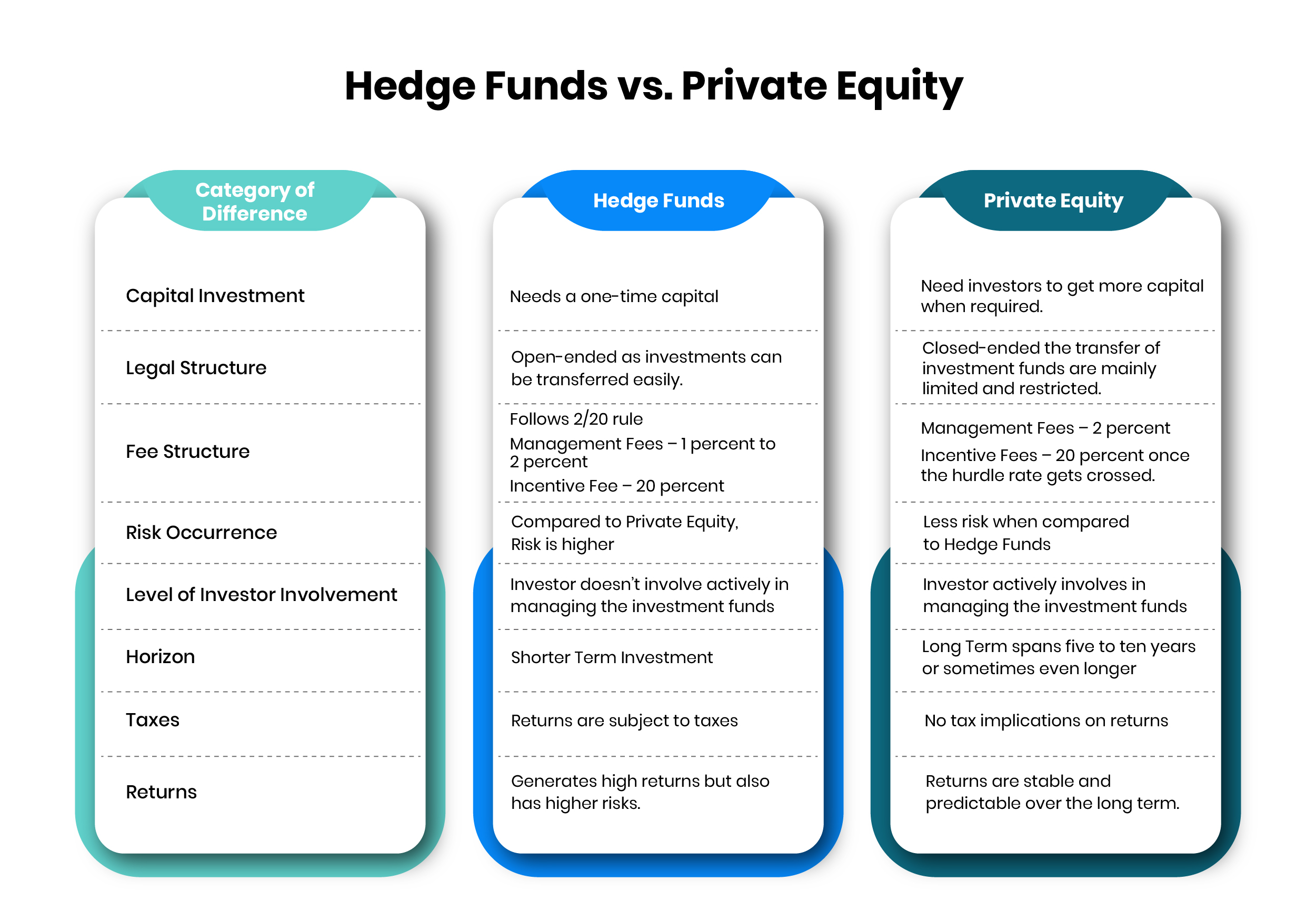

Hedge Fund vs Private Equity: What's the Difference? | USPEC - Source www.uspec.org

The fund's investment process is based on in-depth research and analysis of Finnish companies. The fund managers look for companies with strong fundamentals, good management teams, and attractive valuations. The fund has a diversified portfolio of investments in different sectors of the Finnish economy, including financials, industrials, and consumer goods.

Nordea Osake has a long track record of outperformance. The fund has outperformed the benchmark index, the Helsinki Stock Exchange All-Share Index, over the past 10 years.

Nordea Osake is a good option for investors who are looking for a long-term investment in Finnish equities. The fund has a proven track record of outperformance and is managed by a team of experienced investment professionals.

Key Insights

| Key Insight | Importance |

|---|---|

| Nordea Osake has a long-term investment horizon. | This allows the fund to invest in companies with strong fundamentals and long-term growth potential. |

| The fund is managed by a team of experienced investment professionals. | This gives investors confidence that the fund is being managed by a team with a deep understanding of the Finnish market. |

| Nordea Osake has a diversified portfolio of investments. | This reduces the risk of the fund and helps to ensure that investors receive a consistent return over time. |

Conclusion

Nordea Osake is a leading Finnish equity fund that provides investors with long-term growth potential. The fund has a proven track record of outperformance and is managed by a team of experienced investment professionals. Nordea Osake is a good option for investors who are looking for a long-term investment in Finnish equities.

The fund's long-term investment horizon allows it to invest in companies with strong fundamentals and long-term growth potential. The fund's diversified portfolio of investments reduces the risk of the fund and helps to ensure that investors receive a consistent return over time.

Paul Marcon: Trailblazing Real Estate Entrepreneur And Industry Innovator, Asteroid 2024 Yr4: A Near-Earth Object Of Interest, Lino Ventura: The Legendary French Actor Of Depth And Charisma, Harri Syrjänen: Finnish Musician And Composer, Lembit Peegel: Estonian Composer And Choral Conductor, Eglal Zeiky: Pioneering Egyptian Activist And Feminist, Educational Services: Empowering Students, Transforming Lives, Strasbourg Vs Lille: Ligue 1 Clash For European Ambitions, Tanjong Pagar United Take On DPMM FC In Crucial AFC Cup Clash, Rayo Vallecano V Girona: La Liga Match Preview And Predictions,