Impuesto De Timbre: A Comprehensive Guide To Stamp Duty In Spain

Through extensive analysis and research, we have compiled this guide to provide target audience with a thorough understanding of Impuesto De Timbre. Our aim is to empower our readers to make informed decisions and ensure compliance with Spanish tax regulations.

FAQ

This comprehensive FAQ section provides clear and concise answers to frequently asked questions about Stamp Duty in Spain, serving as a valuable resource for understanding the intricacies of this tax and its implications.

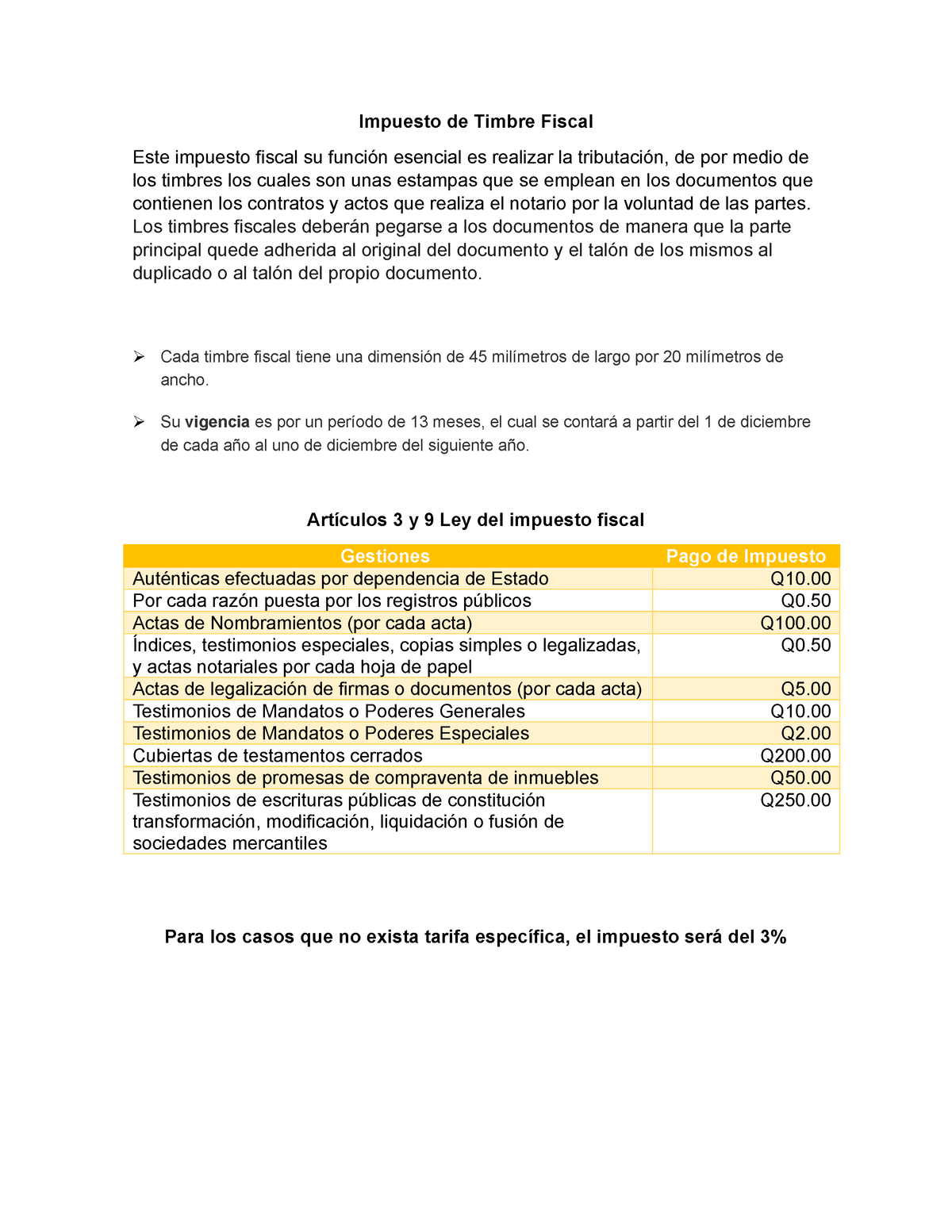

Impuesto de Timbre Fiscal - Los timbres fiscales deberán pegarse a los - Source www.studocu.com

Question 1: What is Stamp Duty in Spain?

Stamp Duty, also known as Impuesto de Actos Jurídicos Documentados (AJD), is a tax levied on legal documents that formally record certain legal acts and transactions in Spain. It is a proportional tax, meaning its amount is based on the value of the transaction or document.

Question 2: What types of documents are subject to Stamp Duty?

A wide range of legal documents are subject to Stamp Duty, including property sale contracts, mortgages, loans, insurance policies, and court decisions. The specific documents and transactions that are taxable are outlined in the Spanish Stamp Duty Law.

Question 3: Who is responsible for paying Stamp Duty?

In most cases, the person or entity acquiring the goods or services covered by the document is responsible for paying Stamp Duty. However, there are certain exceptions to this rule, such as in the case of property transfers where the buyer and seller may share the tax burden.

Question 4: How is Stamp Duty calculated?

The amount of Stamp Duty payable is determined by applying a specified tax rate to the value of the transaction or document. The tax rates vary depending on the type of document and the autonomous community where the transaction takes place.

Question 5: Are there any exemptions or reductions for Stamp Duty?

Yes, there are certain exemptions and reductions available for Stamp Duty in Spain. These exemptions and reductions are typically granted based on the nature of the transaction, the parties involved, or the social or economic purpose of the document.

Question 6: What are the consequences of not paying Stamp Duty?

Failure to pay Stamp Duty within the established сроки can result in penalties and surcharges. Additionally, legal documents that are not properly stamped may not be considered valid or enforceable in court.

By understanding the answers to these frequently asked questions, individuals and businesses can navigate the complexities of Stamp Duty in Spain and ensure compliance with their tax obligations.

To learn more about Stamp Duty in Spain, including detailed information on applicable tax rates, exemptions, and specific scenarios, please refer to the comprehensive guide provided in this article.

Tips

Considering the complexities of stamp duty in Spain, several tips can help ensure compliance and optimize tax efficiency.

Tip 1: Understand the Different Types of Stamp Duty

Spain imposes stamp duty on various legal documents, including contracts, invoices, and official certificates. It is essential to identify the applicable type of stamp duty and its corresponding tax rate.

Tip 2: Determine the Taxable Base

The taxable base for stamp duty is the value of the underlying transaction or document. Accurately determining the taxable base is crucial to avoid under or overpayment of taxes.

Tip 3: Utilize Exemptions and Reductions

Certain transactions and documents are exempt from stamp duty or may qualify for reduced rates. Explore these exemptions and reductions to minimize tax liability.

Tip 4: Keep Accurate Records

Maintain detailed records of transactions and stamp duty paid. These records serve as evidence of compliance and can assist in any potential tax audits.

Tip 5: Seek Professional Advice

If the complexity of Spanish stamp duty poses challenges, consider consulting with a tax professional or legal advisor. They can provide personalized guidance and ensure proper compliance.

By following these tips, individuals and businesses can navigate the complexities of stamp duty in Spain, ensuring accuracy, optimizing tax efficiency, and maintaining compliance with tax regulations.

For a comprehensive exploration of stamp duty in Spain, refer to Impuesto De Timbre: A Comprehensive Guide To Stamp Duty In Spain.

Impuesto De Timbre: A Comprehensive Guide To Stamp Duty In Spain

Understanding 'Impuesto De Timbre' is crucial for navigating stamp duty in Spain. Key aspects to consider include its nature as a tax, its applicability, exemptions, declarations, consequences, and liabilities.

- Tax on Legal Documents: Stamp duty in Spain, 'Impuesto De Timbre', is a tax levied on specific legal documents, such as contracts, invoices, and official certificates.

- Wide Applicability: It applies to a broad range of transactions, including real estate purchases, loans, insurance policies, and court documents.

- Exemptions Exist: Certain documents are exempt from stamp duty, such as those related to healthcare, education, and social security.

- Mandatory Declarations: Taxpayers are required to declare and pay stamp duty within a specified timeframe to avoid penalties.

- Consequences of Non-Compliance: Failure to comply with stamp duty regulations can result in fines and additional tax liabilities.

- Taxpayer Liabilities: Both individuals and entities involved in transactions subject to stamp duty are liable for its payment.

These aspects are interconnected and essential for understanding the complexities of stamp duty in Spain. For instance, exemptions help reduce the tax burden in certain sectors, while declarations ensure that the government collects the appropriate revenue. Non-compliance can lead to significant financial penalties, highlighting the importance of adhering to the regulations.

Impuesto De Timbre: A Comprehensive Guide To Stamp Duty In Spain

Impuesto De Timbre, often referred to as "stamp duty," is a tax levied on certain legal documents in Spain, including contracts, deeds, and other official papers. It is an important source of revenue for the Spanish government and plays a crucial role in ensuring the validity and authenticity of these documents. Understanding the intricacies of Impuesto De Timbre is essential for individuals and businesses operating in Spain, as it can have significant financial and legal implications.

LEGO City Base Espacial y Plataforma de Lanzamiento de Cohetes - 60434 - Source youget.pt

Impuesto De Timbre is a complex and multifaceted topic, encompassing a wide range of legal and practical considerations. A comprehensive guide to stamp duty in Spain would provide invaluable insights into the following key areas:

- Types of documents subject to Impuesto De Timbre

- Calculation of stamp duty based on document type and value

- Exemptions and reductions available for certain types of documents

- Procedure for paying stamp duty

- Consequences of failing to pay stamp duty

A well-structured guide would present this information in a clear and accessible manner, utilizing examples and case studies to illustrate the practical application of the law. It would serve as a valuable resource for legal professionals, accountants, and individuals seeking to navigate the complexities of Impuesto De Timbre in Spain.

Furthermore, a comprehensive guide could explore the broader implications of Impuesto De Timbre within the Spanish legal system. It could discuss its role in preventing fraud and protecting the rights of individuals and businesses. Additionally, it could examine the economic impact of stamp duty and its potential impact on investment and business activity.

Finlandia Talo: The Architectural Masterpiece In Helsinki's Heart, Today's Sagittarius Horoscope: Uncover Your Cosmic Destiny, Third-Grade Results In Al-Bahera Governorate For 2023, SEO-Friendly Title: Unleash Your Outdoor Living Potential: Discover Decko Composite Decking, Unveiling The Enchanting Beauty Of Congo Rdc: A Land Of Diverse Landscapes, Vibrant Cultures, And Untamed Wildlife, Ring In The Year Of The [Animal] With The Lunar New Year Festival, Unlock A World Of Information With La W Radio: The Ultimate Source For News, Talk, And Entertainment, Lotería De Boyacá: Sorteo Extraordinario Del 25 De Enero De 2025, Discover The Enchanting Land Of Dinamarca: A Nature Lover's Paradise, Sapara: Indigenous Amazonian Community Preserves Cultural Heritage And Environmental Stewardship,