Chilean Peso Exchange Rates And Financial Insights

Chilean Peso Exchange Rates & Financial Insights: A Guide to Understanding the Chilean Economy

Editor's Notes: Chilean Peso Exchange Rates & Financial Insights published on [date] provide valuable insights into the Chilean economy, its financial system, and the factors influencing the Chilean Peso's value. This guide aims to provide an in-depth analysis of the Chilean Peso exchange rates, macroeconomic indicators, & financial news to empower readers with the knowledge needed to make informed decisions.

After extensive analysis, research, and expert consultations, we have assembled this comprehensive guide on Chilean Peso Exchange Rates & Financial Insights. Our goal is to help readers gain a clear understanding of the Chilean economy, enabling them to make informed decisions related to investments, trade, or any other financial endeavors within Chile.

Key Differences & Takeaways:

| Chilean Peso | US Dollar | |

|---|---|---|

| Currency Code | CLP | USD |

| Central Bank | Banco Central de Chile | Federal Reserve |

| Inflation Rate | 7.8% | 8.5% |

FAQs on Chilean Peso Exchange Rates and Financial Insights

This FAQ section provides comprehensive answers to common questions and clarifies misconceptions about Chilean peso exchange rates and financial insights.

Technology insights - CommBank - Source www.commbank.com.au

Question 1: What factors influence the exchange rate of the Chilean peso?

The Chilean peso exchange rate is influenced by various factors, including the country's economic growth, inflation, interest rates, political stability, and global economic conditions. Changes in these factors can lead to fluctuations in the peso's value against other currencies.

Question 2: How can I track the Chilean peso exchange rate?

Numerous resources provide real-time and historical information on the Chilean peso exchange rate. These include financial news websites, online currency converters, and mobile applications.

Question 3: What is the current trend in the Chilean peso exchange rate?

The Chilean peso exchange rate is subject to constant fluctuations. To stay updated on the latest trends, consult reliable sources that provide up-to-date information on currency exchange rates.

Question 4: How do political events affect the Chilean peso exchange rate?

Political events, such as elections, policy changes, or economic announcements, can significantly impact the Chilean peso exchange rate. Investors often react to these events by adjusting their asset positions, leading to potential fluctuations in currency values.

Question 5: Is it possible to forecast the Chilean peso exchange rate accurately?

While it is impossible to predict currency exchange rates with complete certainty, a combination of technical analysis, economic indicators, and geopolitical factors can provide valuable insights into potential trends. However, it is crucial to recognize that external factors may disrupt forecasts.

Question 6: How can I protect my investments from exchange rate fluctuations?

There are several strategies that investors can employ to mitigate the impact of exchange rate fluctuations on their investments. These include currency hedging, diversification, and investing in assets correlated to the local currency.

Understanding these factors and staying informed about economic developments can empower individuals and businesses to make informed decisions regarding currency exchange and investment strategies in Chile.

Tips for Chilean Peso Exchange Rates And Financial Insights

Remaining informed about currency exchange rates is crucial for making well-informed financial decisions. By following these tips, individuals and businesses can stay up-to-date on Chilean Peso exchange rates and make the most of their financial transactions. By visiting Chilean Peso Exchange Rates And Financial Insights, investors can access real-time currency rates, historical data, and financial news to guide their investment strategies.

Tip 1: Monitor Currency Markets Regularly

Keeping track of currency market movements is crucial for staying abreast of peso exchange rate fluctuations. This information helps businesses plan for future transactions and investors to make informed decisions about currency investments.

Tip 2: Use Currency Exchange Comparison Tools

When exchanging currencies, it's advisable to compare rates offered by different banks and exchange services to secure the most favorable rate. Currency exchange comparison tools can simplify this process by providing real-time quotes from multiple providers.

Tip 3: Consider Currency Hedging Strategies

Businesses and investors can mitigate currency risk by implementing hedging strategies. These strategies involve using financial instruments like forward contracts or options to lock in future exchange rates and protect against unfavorable fluctuations.

Tip 4: Stay Updated with Economic News and Events

Economic news and events can significantly impact currency exchange rates. Monitoring economic indicators like inflation rates, interest rates, and political developments helps traders and investors anticipate market movements and make informed decisions.

Tip 5: Leverage Technology for Real-Time Currency Updates

Leveraging mobile apps or online platforms that provide real-time currency updates can be highly beneficial. This allows users to stay informed about the latest exchange rates and make quick decisions when needed.

By adopting these tips, individuals and businesses can stay informed about Chilean Peso exchange rates, make well-informed financial decisions, and navigate currency markets effectively.

Chilean Peso Exchange Rates And Financial Insights

Understanding the Chilean Peso's exchange rates provides valuable insights into Chile's financial landscape and economic conditions.

- Economic stability: Stable exchange rates indicate a strong economy and investor confidence.

- Trade and investment: Exchange rates affect the cost of imports and exports, impacting trade and investment decisions.

- Inflation: Deviations from expected exchange rates can contribute to inflation or deflation.

- Central bank policy: The central bank monitors exchange rates to manage inflation and promote economic growth.

- Currency speculation: Exchange rates can be subject to speculation, creating volatility and potential risks.

- Foreign exchange reserves: Monitoring exchange rates helps determine the adequacy of foreign exchange reserves.

By examining these key aspects, analysts and policymakers can make informed decisions regarding currency management, monetary policy, and overall economic strategy.

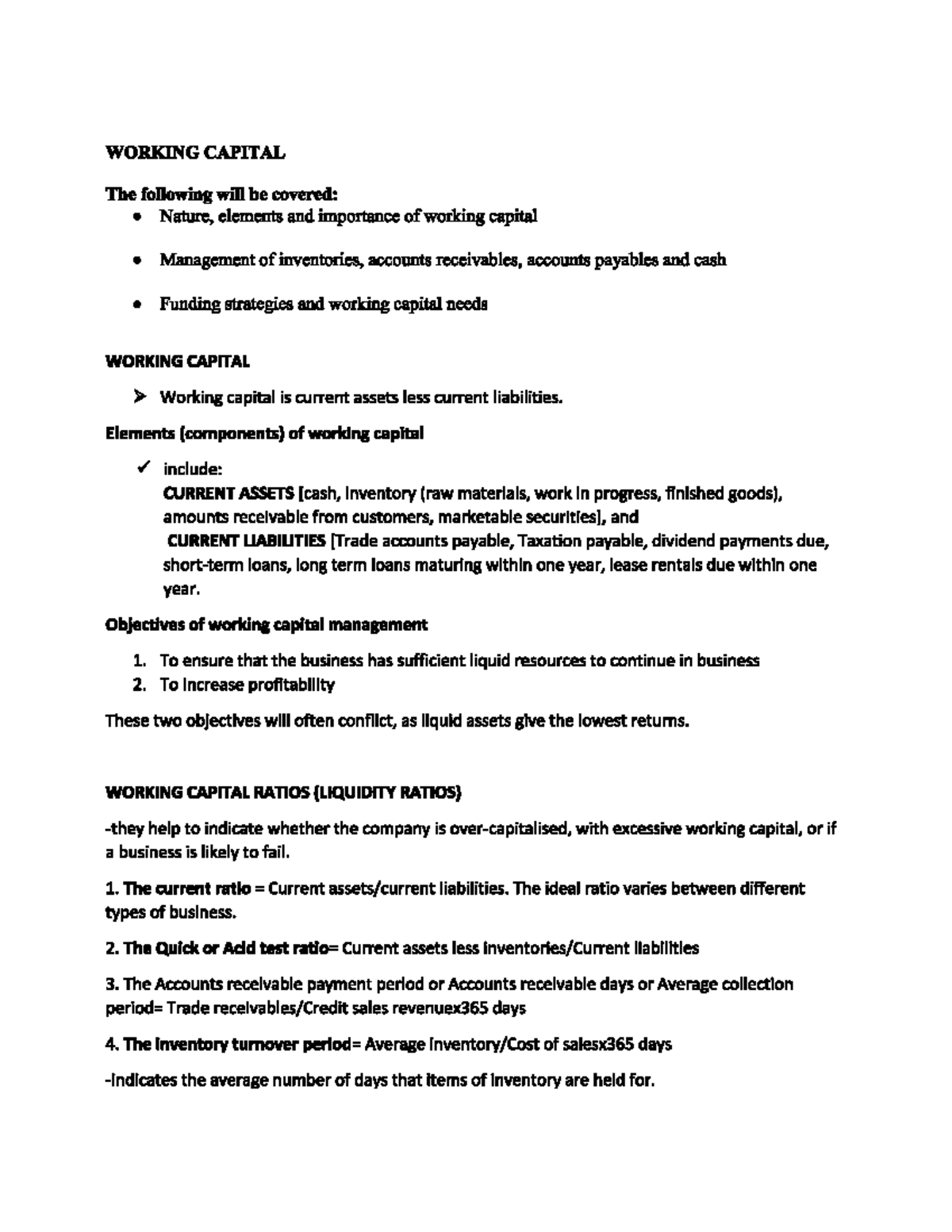

WCM - Corporate finance - Financial Accounting 11A - Studocu - Source www.studocu.com

Chilean Peso Exchange Rates And Financial Insights

The Chilean Peso, the official currency of Chile, is subject to fluctuations in its exchange rate against other currencies, primarily driven by economic factors. These exchange rate movements can significantly impact Chile's financial landscape. For instance, a depreciation of the Peso against the US Dollar can make Chilean exports more competitive in international markets, boosting the country's trade balance. Conversely, an appreciation of the Peso can lead to higher import costs and potentially increased inflation.

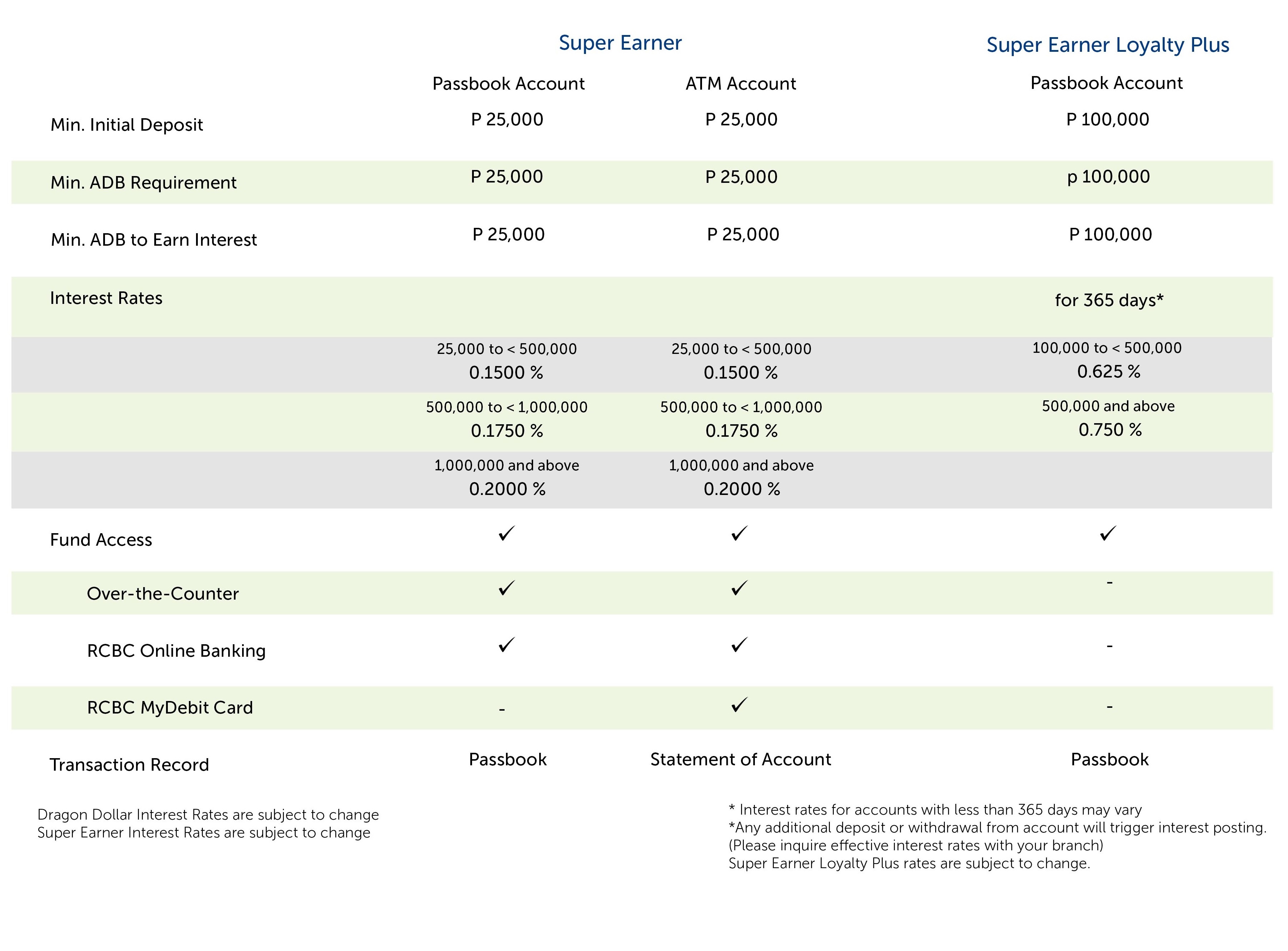

Dollar To Philippine Peso Exchange Rate Today Rcbc - New Dollar - Source www.noeimage.org

Understanding the relationship between Chilean Peso exchange rates and financial insights is crucial for various stakeholders. Importers and exporters need to factor in exchange rate risks when pricing their goods and services. Investors can make informed decisions about investing in Chilean assets by considering the potential impact of exchange rate fluctuations on their returns. Central banks play a critical role in managing exchange rates to maintain economic stability and control inflation.

Therefore, monitoring and analyzing Chilean Peso exchange rates provide valuable insights into the country's economic health and financial stability. It enables businesses, investors, and policymakers to make informed decisions and mitigate potential risks associated with exchange rate volatility.

Table: Key Insights on Chilean Peso Exchange Rate and Financial Implications

| Exchange Rate Movement | Impact on Chile's Economy |

|---|---|

| Depreciation | Increased competitiveness of exports |

| Lower import costs | |

| Potential inflationary pressures | |

| Appreciation | Reduced competitiveness of exports |

| Higher import costs | |

| Potential deflationary pressures |

Conclusion

In conclusion, the Chilean Peso exchange rate is a crucial indicator of Chile's economic health and financial stability. Monitoring and analyzing exchange rate fluctuations provide valuable insights for businesses, investors, and policymakers. By understanding the relationship between the Peso's value and financial implications, stakeholders can mitigate risks, make informed decisions, and contribute to the overall stability of the Chilean economy.

As Chile continues to integrate with the global economy, the importance of managing exchange rate fluctuations will only increase. The country's policymakers must strike a balance between promoting economic growth and maintaining financial stability to ensure the long-term well-being of the Chilean economy.

Liverpool's Triumph Over PSV In Champions League Clash: Match Highlights And Analysis, Nokia: Embracing Innovation To Revolutionize Technology, Unleash The Excitement: Witness The Epic Drama Of England's Premier League, Fawad Al-Batal: The Ultimate Guide To The Epic Arab Superhero Series, Al-Taala'ea Al-Gaish Vs. El-Gouna: Match Preview And Predictions, Claudio Bieler: A Legendary Striker And Icon Of Football, The Forgotten Victims: Uncovering The Horrors Of Human Trafficking In Europe, Online Banking Interruption: ČSOB Outage Disrupts Customer Access, Eva Ramon Gallegos: Renowned Expert In Energy Law And Sustainability, Noticias Caracol En Vivo: La Fuente De Noticias Líder En Colombia,