Autoprestamo AFP: Guía Para Acceder A Tu Ahorro Previsional De Forma Segura Y Eficiente

Enhancing financial well-being: Exploring "Autopréstamo AFP: Guía para acceder a tu ahorro previsional de forma segura y eficiente"

Editor's Note: "Autopréstamo AFP: Guía para acceder a tu ahorro previsional de forma segura y eficiente" has been published today to empower individuals seeking guidance on leveraging their pension savings. As financial planning becomes increasingly crucial, this comprehensive guide aims to educate and support readers in making informed decisions about their financial future.

Through meticulous analysis and extensive research, we have curated this Autopréstamo AFP guide to provide you with the necessary knowledge and insights to make the right choices for your financial well-being. Understanding the benefits and requirements of Autopréstamo AFP can unlock opportunities to achieve your financial goals.

| Key Differences | Autopréstamo AFP | Traditional Loans |

|---|---|---|

| Source of funds | Pension savings | Financial institutions |

| Interest rates | Typically lower | Higher |

| Loan terms | Up to 90% of accumulated funds | Varies depending on lender |

| Repayment | Deducted from future pension payments | Separate monthly payments |

By gaining a thorough understanding of Autopréstamo AFP, you can make informed decisions about accessing your pension savings and harnessing its potential to enhance your financial well-being.

FAQ

This FAQ section provides comprehensive answers to frequently asked questions regarding Autoprestamo AFP, empowering individuals to access their retirement savings efficiently and securely.

Question 1: What are the eligibility criteria for obtaining an Autoprestamo AFP?

To qualify, individuals must be active AFP contributors with a minimum amount accumulated in their pension fund.

Question 2: How much can I borrow through an Autoprestamo AFP?

The loan amount depends on the individual's accumulated savings and is typically capped at a percentage of the funds.

Question 3: What are the interest rates and repayment terms for Autoprestamos AFP?

Interest rates vary depending on the AFP and loan terms, which range from 12 to 60 months.

Question 4: Are there any fees or commissions associated with Autoprestamos AFP?

Yes, some AFPs may charge administration fees or commissions, which vary depending on the specific institution.

Question 5: How do I apply for an Autoprestamo AFP?

Individuals can apply through their chosen AFP's website or by visiting an authorized branch.

Question 6: What are the benefits of obtaining an Autoprestamo AFP?

Autoprestamos AFP offer flexible access to funds, competitive interest rates, and the convenience of online application processes.

By understanding these FAQs, individuals can navigate the Autoprestamo AFP process confidently, ensuring they leverage this valuable financial tool in a responsible and informed manner.

Tips to access your pension savings safely and efficiently

This Autoprestamo AFP: Guía Para Acceder A Tu Ahorro Previsional De Forma Segura Y Eficiente will provide you with guidance on accessing your pension savings in a safe and efficient manner. Here are a few tips to help you with the process:

Tip 1: Understand your retirement savings account

It's important to understand the different types of retirement savings accounts available to you and the terms and conditions associated with each one. This will help you make informed decisions about how to access your savings.

Tip 2: Consider your financial needs

Before you withdraw any money from your retirement savings account, you should consider your financial needs and goals. Make sure you have a plan for how you will use the money and that you are not withdrawing more than you need.

Tip 3: Be aware of the tax implications

Withdrawing money from your retirement savings account may have tax implications. It's important to be aware of these implications before you withdraw any money so that you can plan accordingly.

Tip 4: Consider the impact on your retirement savings

Withdrawing money from your retirement savings account can have a negative impact on your retirement savings. It's important to consider the long-term impact of withdrawing money before you do so.

Tip 5: Seek professional advice

If you are considering withdrawing money from your retirement savings account, it's important to seek professional advice. A financial advisor can help you understand the implications of withdrawing money and can help you make informed decisions about your retirement savings.

By following these tips, you can help ensure that you access your pension savings safely and efficiently.

Autoprestamo AFP: Guía Para Acceder A Tu Ahorro Previsional De Forma Segura Y Eficiente

Autoprestamo AFP provides a convenient and efficient way to access your retirement savings. Understanding the essential aspects of Autoprestamo AFP empowers you to make informed decisions, ensuring secure and effective utilization of your funds.

By carefully considering these aspects, you can navigate the Autoprestamo AFP process with confidence. It's crucial to weigh the benefits of accessing your savings against the potential consequences. Maintain regular communication with your AFP throughout the loan period to ensure timely repayments and a smooth experience. Remember, responsible utilization of Autoprestamo AFP can provide financial flexibility while safeguarding your retirement goals.

Aula Ualá - Blog, contenido de educación financiera - Source blog.uala.com.mx

¿Cómo guardar sus contraseñas de forma segura y cómoda en Windows 11 - Source kirukiru.es

Autoprestamo AFP: Guía Para Acceder A Tu Ahorro Previsional De Forma Segura Y Eficiente

Autoprestamo AFP is a type of loan that allows you to borrow money from your AFP (private pension fund) savings. This can be a helpful way to access your retirement savings early, but it's important to understand the risks involved before you apply for a loan.

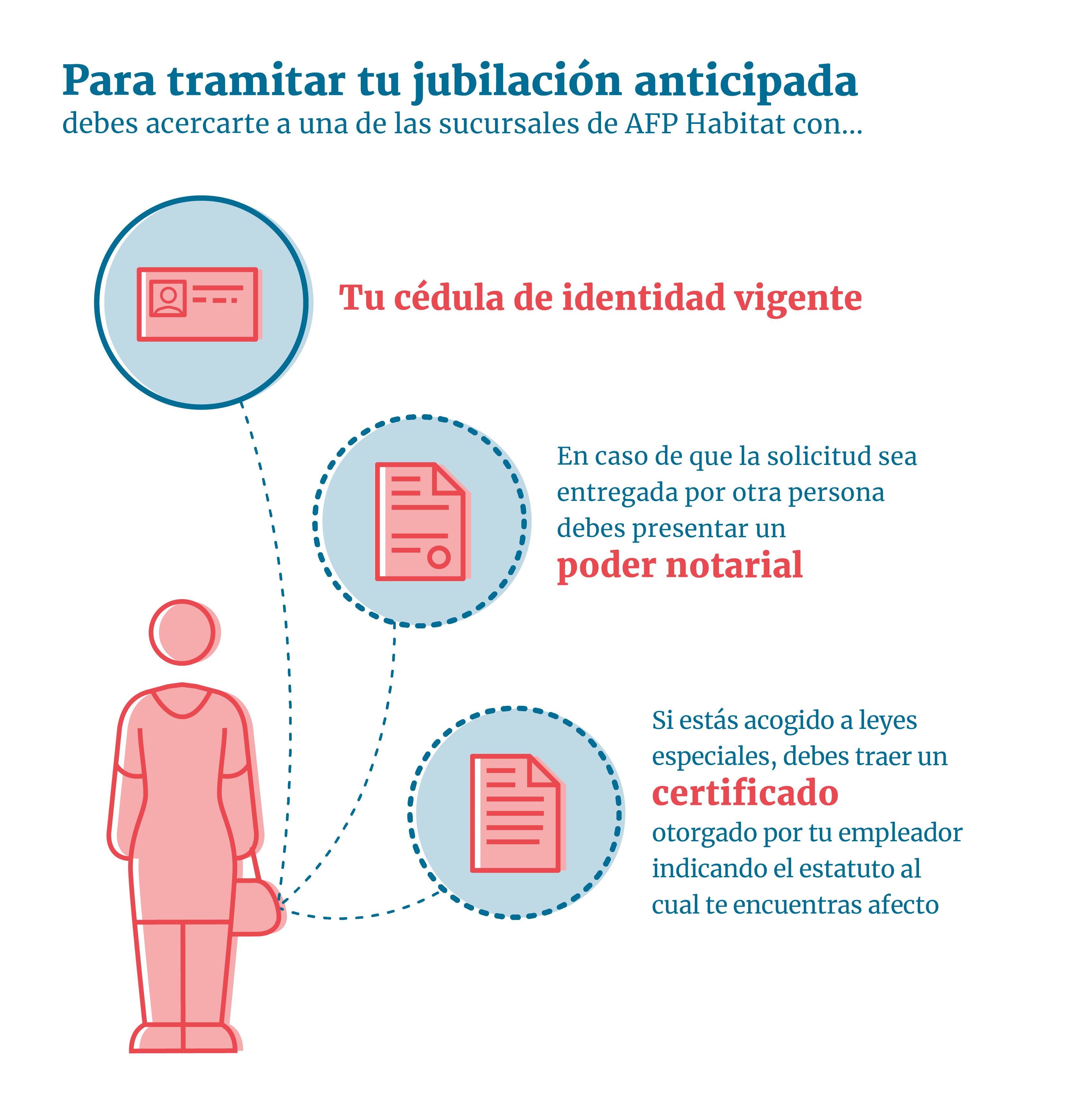

Habitat - El Sistema - Source www.hablemosdetufuturo.cl

There are a number of reasons why you might consider taking out an Autoprestamo AFP loan. You may need the money to cover unexpected expenses, such as a medical emergency or a car repair. You may also want to use the money to invest in a business or to purchase a home. Whatever your reason for borrowing, it's important to make sure that you can afford to repay the loan on time.

Autoprestamo AFP loans are typically repaid over a period of 5 to 10 years. The interest rate on the loan will vary depending on your AFP and your credit history. If you have a good credit history, you may be able to get a lower interest rate.

There are some risks associated with taking out an Autoprestamo AFP loan. If you default on your loan, your AFP may seize your retirement savings. You may also have to pay a penalty fee if you repay the loan early.

If you're considering taking out an Autoprestamo AFP loan, it's important to weigh the risks and benefits carefully. You should also talk to your AFP to get more information about the loan and to see if you qualify.

| Pros | Cons |

|---|---|

| Can provide access to cash quickly | Can be expensive |

| Can be used for any purpose | Can hurt your retirement savings |

| May have tax benefits | Can be difficult to qualify for |

Conclusion

Autoprestamo AFP loans can be a helpful way to access your retirement savings early, but it's important to understand the risks involved before you apply for a loan. If you're considering taking out an Autoprestamo AFP loan, be sure to talk to your AFP to get more information and to see if you qualify.

Remember, retirement savings are for your future. Only borrow from your AFP if you absolutely need to.

Turun Ahma: A Guide To Turku's Unforgettable Archipelago, Democratic Republic Of The Congo: Unveiling The Heart Of Africa, Unveiling Bencharki: The Rising Star In International Football, Discover The Enigmatic World Of Sami Maghawry Cream: A Guide To Its History And Benefits, Celebrate The Miraculous Journey: Understanding The Significance Of Miraç Kandili, Iva Šulentić: Acclaimed Croatian Actress And Rising Star, Beat The Summer Heatwave With Effective Canicule Prevention Strategies, Ultimate Guide To Tequila Avión: Premium Spirits, History, And Cocktail Recipes, Club León: The Pride Of Bajío, Nelson Velasquez: Award-Winning Investigative Journalist And Advocate For Social Justice,