5 Essential Pensioner Allowances: Maximizing Your Retirement Benefits

5 Essential Pensioner Allowances: Maximizing Your Retirement Benefits

Are you preparing for retirement or already enjoying this phase of your life? If so, maximizing your retirement benefits is crucial.

Editor's Note: "5 Essential Pensioner Allowances: Maximizing Your Retirement Benefits" has been published today, July 11, 2023, to provide valuable insights into the essential allowances available to pensioners. Understanding these allowances can significantly enhance your retirement income and quality of life.

Through extensive analysis and research, we have compiled this comprehensive guide to help you navigate the often complex world of pensioner allowances. By leveraging these allowances, you can optimize your retirement income and enjoy a more financially secure future.

Retirement card leaving pensioner funny granny Nan | Etsy - Source www.etsy.com

Key Takeaways:

- These allowances offer tax-free income, reduce expenses, and provide access to additional benefits.

- Understanding and utilizing these allowances requires careful planning and consideration.

- By maximizing these allowances, pensioners can significantly improve their financial well-being and overall retirement experience.

Transitioning to the main article topics, we will delve into each essential pensioner allowance, explaining its benefits, eligibility criteria, and how to claim it. Stay tuned for our detailed analysis and practical tips to help you maximize your retirement income.

FAQ

This FAQ section provides answers to some frequently asked questions about maximizing retirement benefits through essential pensioner allowances.

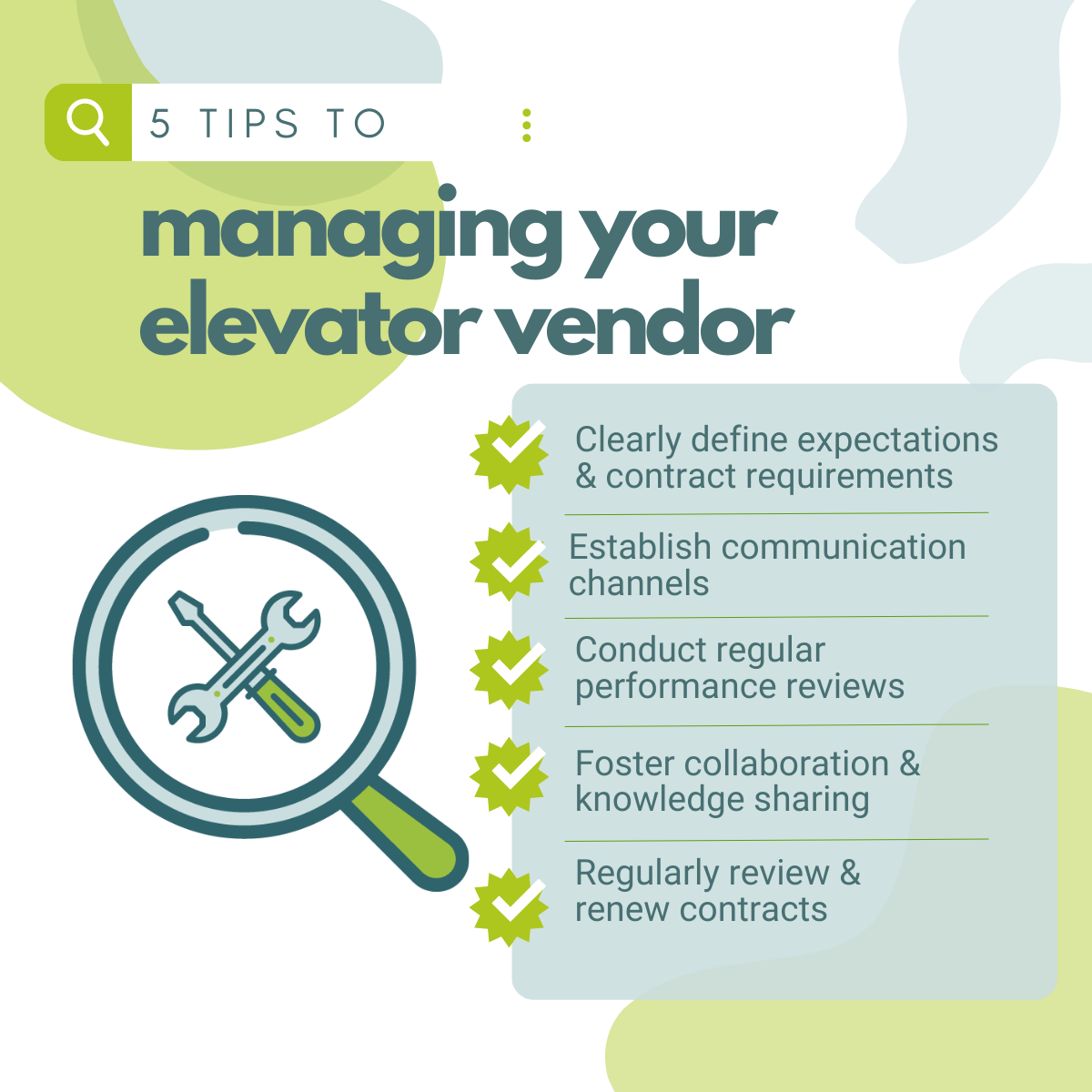

Maximizing the Efficiency of Your Elevator Vendor: 5 Essential Tips - Source auditmate.com

Question 1: What are the key eligibility criteria for these allowances?

To be eligible for these allowances, individuals must meet certain requirements, including reaching a specific age, having contributed to a pension plan, and meeting income and residency criteria.

Question 2: How can I determine the amount of allowance I am entitled to?

The amount of allowance varies depending on factors such as the specific allowance, the individual's income, and the type of pension they receive. It is advisable to consult with the relevant government agency or pension provider to obtain accurate information.

Question 3: Are there any restrictions or limitations associated with these allowances?

Yes, certain restrictions or limitations may apply to these allowances. For instance, some allowances may be subject to income or asset limits, while others may have specific age requirements.

Question 4: How do I apply for these allowances?

The application process for these allowances typically involves submitting an application form along with supporting documentation. The relevant government agency or pension provider will provide guidance on the specific application procedure.

Question 5: What should I do if I need assistance understanding or accessing these allowances?

If you require assistance, it is recommended to contact the relevant government agency or pension provider. They can provide information, guidance, and support throughout the process.

In summary, understanding and utilizing these essential pensioner allowances can significantly enhance your retirement benefits. By being aware of eligibility criteria, application processes, and any potential limitations, you can optimize your retirement income.

Transition to the next article section.

Tips to Maximize Retirement Benefits

Understanding and utilizing pensioner allowances can significantly enhance the financial well-being of retirees. 5 Essential Pensioner Allowances: Maximizing Your Retirement Benefits outlines these essential allowances, providing guidance for maximizing retirement income.

Tip 1: Personal Allowance

The personal allowance is a tax-free threshold applied to all income, including pensions. For the 2023/24 tax year, it stands at £12,570. This allowance effectively reduces the amount of income subject to taxation, allowing retirees to retain more of their pension income.

Tip 2: Marriage Allowance

Married couples or those in civil partnerships may be eligible for the marriage allowance. This allowance allows one spouse to transfer a portion of their personal allowance to their partner, reducing their tax liability. For the 2023/24 tax year, the maximum transferable amount is £1,260, resulting in potential tax savings of up to £252 per year.

5 Essential Pensioner Allowances: Maximizing Your Retirement Benefits

Retirement is a significant life stage, and ensuring financial security is paramount. Pensioner allowances play a crucial role in enhancing retirement benefits and providing a comfortable lifestyle. This article explores five essential pensioner allowances that retirees should be aware of.

Your Benefits, Allowances, and Support Systems as a UN Volunteer - Source www.unv.org

- Personal Allowance: Reduces taxable income, maximizing disposable income.

- Pensioner Tax Credit: Additional tax relief specifically for pensioners, lowering tax liability.

- State Pension: Government-funded pension providing a basic level of income for retirees.

- Additional State Pension: Supplemental pension for those who have made additional National Insurance contributions.

- Winter Fuel Payment: Annual payment to help with heating costs during winter months.

- Pension Credit: Means-tested benefit designed to top up low pension income.

These allowances can significantly boost retirement income and improve overall well-being. Understanding and utilizing them effectively ensures a financially secure and comfortable retirement. It is recommended to consult with a financial advisor or relevant authorities for personalized guidance and to maximize retirement benefits.

5 Essential Pensioner Allowances: Maximizing Your Retirement Benefits

Pensioner allowances play a crucial role in maximizing retirement benefits. These allowances are designed to provide financial support to pensioners and help them maintain a comfortable standard of living during their golden years. Understanding the connection between these allowances and retirement benefits is essential for effective financial planning.

Pensioner allowances can reduce the tax burden on retirement income, thereby increasing disposable income. Additionally, these allowances can help bridge the gap between pension income and expenses, ensuring financial stability and peace of mind. By maximizing these allowances, pensioners can enjoy a higher quality of life and financial security in retirement.

For example, the personal allowance is a tax-free amount that can be deducted from taxable income. Pensioners can also claim additional allowances such as the age allowance and the married couple's allowance. Utilizing these allowances can significantly reduce the amount of tax payable, resulting in higher net income.

Furthermore, understanding the specific eligibility criteria and application processes for these allowances is crucial. Pensioners who fail to claim these allowances may miss out on substantial financial benefits. By actively seeking information and guidance, pensioners can ensure they receive the maximum allowances available to them.

In conclusion, the connection between pensioner allowances and retirement benefits is evident. Maximizing these allowances can lead to increased disposable income, financial stability, and a higher quality of life during retirement. Pensioners should prioritize understanding and utilizing these valuable allowances to ensure a secure and fulfilling retirement.

2021 Clothing Allowances | Military.com - Source www.military.com

| Allowance | Description | Eligibility | Benefits |

|---|---|---|---|

| Personal Allowance | Tax-free amount deducted from taxable income | All pensioners | Reduces tax burden |

| Age Allowance | Additional allowance for pensioners over a certain age | Pensioners meeting specific age criteria | Further reduces tax burden |

| Married Couple's Allowance | Allowance for married couples | Married pensioners | Provides tax relief for couples |

| Disability Allowance | Allowance for pensioners with disabilities | Pensioners meeting disability criteria | Financial support for pensioners with additional expenses |

| Carer's Allowance | Allowance for pensioners caring for others | Pensioners providing significant care | Financial recognition for caring responsibilities |

Conclusion

Pensioner allowances are essential components of retirement planning, providing significant financial benefits and supporting the well-being of pensioners. By maximizing these allowances, pensioners can reduce their tax burden, increase their disposable income, and enhance their overall financial security.

However, it's crucial for pensioners to be aware of eligibility criteria and application processes to ensure they receive the maximum allowances available to them.Seeking professional advice or consulting relevant resources can help pensioners navigate the complexities of pensioner allowances and maximize their retirement benefits.

Remember, a comprehensive understanding of pensioner allowances and their connection to retirement benefits empowers pensioners to make informed decisions, optimize their financial situation, and enjoy a secure and fulfilling retirement.

Elias: The Innovative Software Revolutionizing Patient Care In The Digital Age, Kuopio's Eurojackpot Triumph: Uncover The Winnings And History, Diala Barakat: Award-Winning Jordanian Architect And Trailblazer, Unveiling The Dark Truth: The Sinister Crimes That Haunt Society, Zamalek Vs El Gouna FC: Egyptian Premier League Matchup Preview And Analysis, International School For Human Development, Danuše Nerudová: Economist, Presidential Candidate, And Rising Star In Czech Politics, The Extraordinary Legacy Of Roman Joch: A Journey Through Architectural Masterpieces, Evacuation Center Evakuiran Arena Centar: A Safe Haven In Times Of Need, Beat The Summer Heatwave With Effective Canicule Prevention Strategies,